Great Tips for Healthy Holiday Eating

December 18, 2024

PTSD: Symptoms and Truths

December 18, 2024By Susannah Wollman

Planning for a Healthy New Year

Figuring out what you need to plan for health-wise is a life stage consideration. Depending on your age and your particular genetic make-up, you may need check-ups or not. What about insurance? Every healthcare plan should cover preventative measures as well as wellness checkups and illness/injury coverage.

Is an annual physical really necessary?

There is a growing body of health practitioners who don’t believe annual physicals for healthy adults without risk factors are necessary.1 In fact, the name “annual physical” really should be called “periodic health assessment” instead. Of course, if you have had health problems in the past, keeping abreast of the problem is always wise. It’s best if you have a relationship with a doctor whom you trust. Establishing that relationship is an important step in staying healthy. The guidelines now say that adults from age 18 to 40 should have a physical exam every five years, and every one to three years thereafter.2

When do adults need a checkup?

Obviously, if you are sick or have a symptom that could indicate illness, seeking a doctor’s help is important. If you are suffering from chronic conditions, managing them means you need to have regular checkups according to your doctor’s advice. If you have been prescribed a new medication, you’ll probably want to check with your doctor if you experience side effects.

Individuals with risk factors like smoking or obesity are also good reasons to see your doctor regularly. Any family history of health issues may mean you need to have regular checkups as well.

Your stage of life is an important issue, too. If you are pregnant, checkups according to your OBGYN are extremely important and should not be missed. Family planning and lifestyle issues like STD prevention and a healthy diet are essential as well.

What about preventive care?

Three types of preventive care should be considered. The first type—primary prevention—includes interventions that can completely prevent diseases in people at risk (such as immunizations for measles, mumps, etc.).

The second type—secondary prevention—includes identifying specific risk factors for particular issues, like PAP smears to screen for ovarian cancer or blood pressure to catch hypertension before it becomes dangerous.

The last type—tertiary prevention—manages diseases that have been identified so that they do not get worse or reoccur (like a heart attack after heart disease is found).

What kinds of health issues need to be planned for?

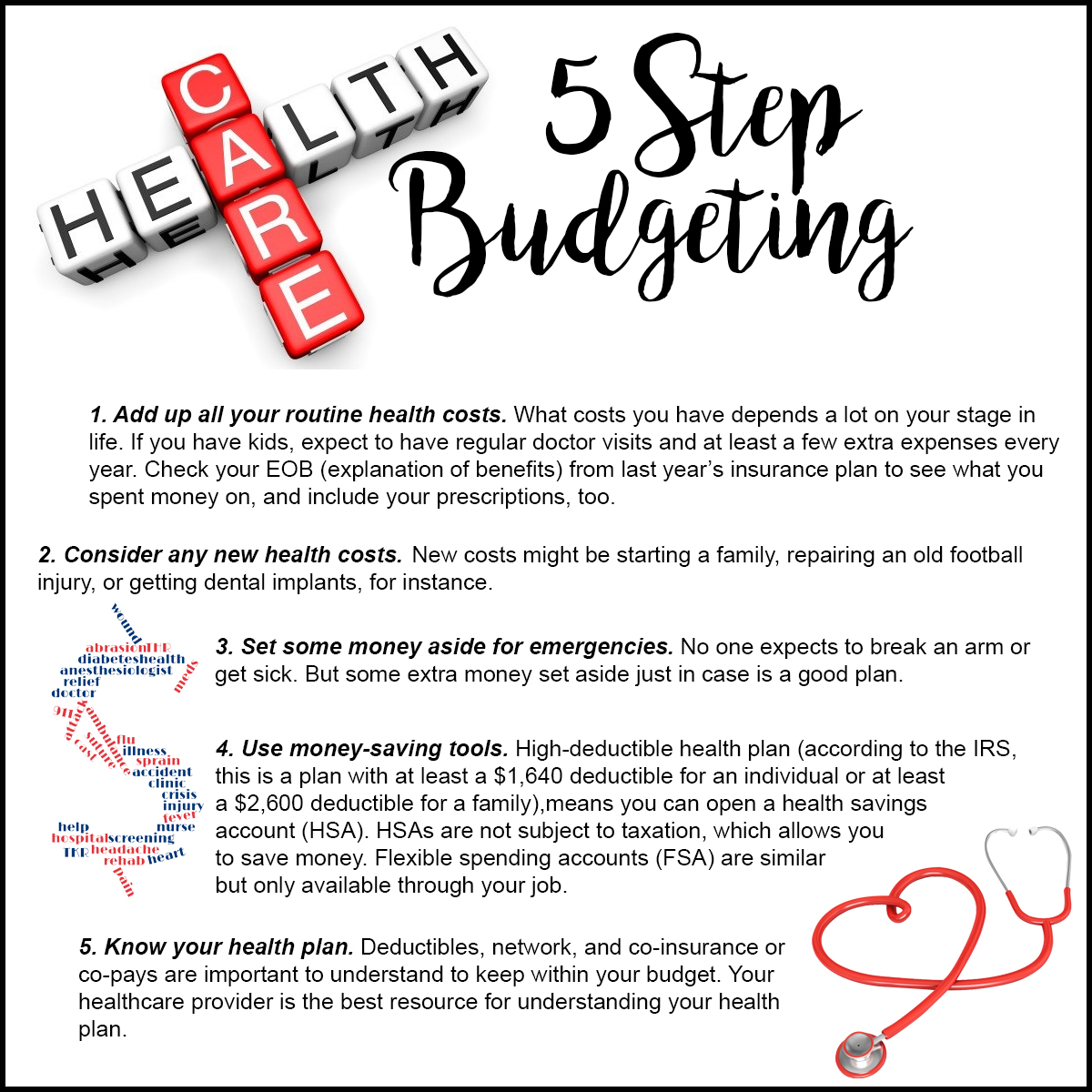

There are a few health issues that should always be part of your annual budget. Those include:

- Regular doctor visits for all children up to the age of 18

- Dental care at least twice a year for cleanings and x-rays for everyone

- Regular eye exams, especially as you age

After those are budgeted for, build in extra money to cover unexpected health problems. If you are over 55 or have children in the home, unanticipated costs can come from broken bones, chronic illness, or catastrophic events. If you are a high-risk individual, prescriptions and/or vitamin and mineral supplements to prevent problems should be budgeted in. Medical equipment, such as a CPAP machine’s supplies or diabetic supplies should also be accounted for.

What’s the best way to budget for these?

There are many ways to establish a budget. Normal, regular healthcare is not difficult to budget for because your insurance plan’s EOB (explanation of benefits) breaks out what is paid and what is not. (If you have trouble understanding your benefits, your insurance provider can help you.)

But when it comes to paying for the things your health care plan doesn’t cover, what do you do?

Many people use a money-saving tool called a Health Savings Account. HSAs can greatly benefit those with high-deductible health insurance plans to pay for uncovered expenses. When you (or anyone else) contributes to your HSA, funds aren’t subject to federal income tax and your earnings grow tax-free. If you don’t use all the money in your account, it rolls over to the next year.

However, high-deductible health plans (a requirement for HSAs) may not be your best option. especially if you expect significant healthcare expenses. A plan that has higher premiums but covers more may be a better choice.3

Another way to budget is to use a Flexible Spending Account (FSA) through your employer. FSAs allow you to contribute $2,600 as an individual and $5,300 as a family. Compared to HSAs, which allow $800 more as an individual and $1,600 more as a family, these accounts are great for those who don’t anticipate high medical costs. FSAs cannot move with you if you change jobs, but HSAs can.4

There is no doubt that medical expenses are expensive, yet not budgeting for health expenses can cost much more than the premiums and deductibles. As of January 1, 2019, there is no longer an individual mandate for health insurance, but responsible people set up their budgets to include the healthcare most individuals and families will use in the coming year.

[1] Health Checkups. (n.d.). https://www.choosingwisely.org/patient-resources/health-checkups/

[2] Jr., W. C. S. (2018, October 19). Wellness Checkup: The Importance of Annual Physical Exam.

[3] Folger, J. (2019, November 20). Health Savings Accounts: Advantages and Disadvantages.

[4] Miller, M. (2019, December 8). What’s the Difference Between an FSA and HSA?